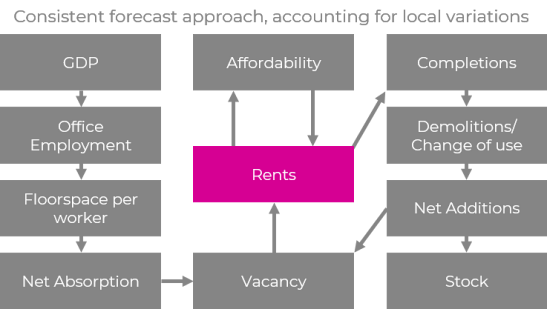

Our Independent Research Approach

PMA was set up in 1981 by two leading academics, Professors Richard Barras and David Cadman, who were pioneers in forecasting property markets. The aim was to apply a consistent approach to collecting and analysing property data, to develop market-leading econometric forecasts, and to employ the best analysts to deliver independent and objective insight.

Originally focused on the UK, with the creation of the Eurozone we developed European services in 2000, and quickly after Asia-Pacific and US services were launched to meet our clients’ global business needs.